Facebook Ads is a powerful tool for digital marketing, but ad payments often get blocked. Transactions fail, accounts get frozen, and campaigns grind to a halt. The culprit? Facebook's security algorithms. They're designed to protect the system from fraud, but they frequently cause issues for legitimate advertisers.

So, how do you prevent these blocks? The answer is to use virtual cards specifically designed for advertising. These cards ensure stable transactions and help navigate common payment issues. In this article, we'll explore why Facebook blocks payments and how to avoid these problems. We'll also review five virtual card services: PSTNET, CardsPro from Capitalist, Spendge, Traffic Heroes, and LinkPay.

Virtual card services for Facebook Ads

The market is flooded with virtual card providers, but not all of them are suitable for ad payments. Here are five trusted solutions with positive reviews from media buyers and ad agencies. Each service has unique features, so it's crucial to review their terms before making a choice.

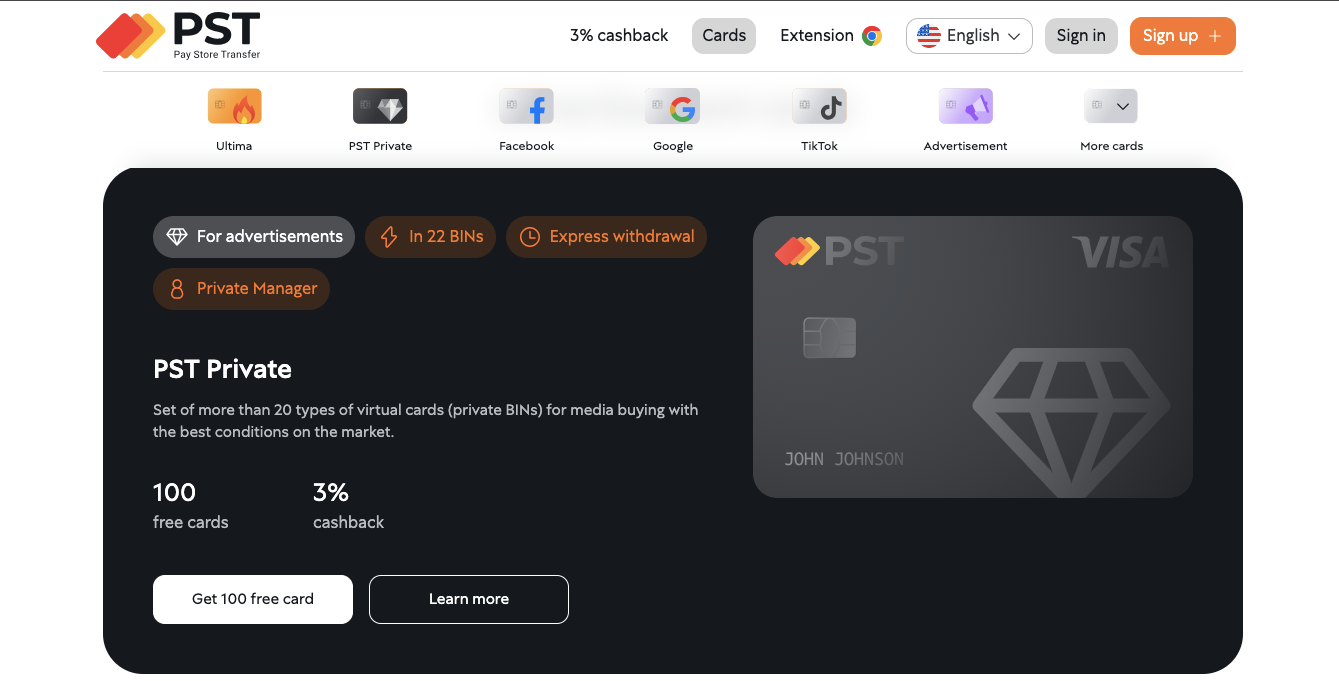

1. PSTNET

PSTNET stands out for its specialised features tailored for media buying. It offers not only top-tier cards for Facebook Ads but also a 3% cashback programme, a referral system, and zero transaction fees.

PSTNET's Facebook-friendly virtual cards operate on Visa/Mastercard networks and are well accepted by Meta's verification system. These cards are issued through reputable banks in the US and Europe and come in both debit and credit options.

According to user reviews, the best virtual credit cards for Facebook Ads can be obtained through the PST Private programme. This programme offers a 3% cashback on ad spend, allows users to issue up to 100 cards per month for free, and enables card top-ups with a 3% fee. No proof of ad spend is required --- users simply select a plan and make a payment.

PSTNET's pricing model is highly advantageous: no fees for transactions, withdrawals, or frozen/blocked card operations. The referral programme allows users to earn up to 90% of profits from invited users' transactions.

Features:

- BINs: 25+ trusted BINs from US and European banks

- Card top-ups: 18 cryptocoins (BTC, USDT TRC-20, ERC-20, and more), SWIFT/SEPA bank transfers, other Visa/Mastercard cards

- Team tools: Task allocation, role assignment, and card limit settings

- Budget management tools: Detailed financial reports

- Security: 3D Secure Technology, Two-Factor Authentication

- Notifications & 3DS Codes: Telegram bot, messages

- Registration: Apple ID, Google, Telegram, WhatsApp, or email

- Support: Instant responses via Telegram, WhatsApp, or live chat

- Additional perks: Special BIN checker "Pulse"

2. Capitalist

Capitalist is a well-known financial platform for online transactions. It offers specialised Facebook Ads payment cards under the CardsPro brand. These Visa/Mastercard cards are issued through reputable banks in the US, Europe, and the UK. Payments can be made in USD and EUR. While these cards are versatile for different ad platforms, users can also select specific BINs. A dedicated account manager is available to help choose the best card for Facebook Ads.

Users praise Capitalist's cards for their low decline rates and competitive fees. There are no transaction fees or hidden charges, though a decline fee of up to $0.30 may apply.

Features:

- BINs: 9 BINs from US, European, and UK banks

- Card top-ups: 5 cryptocoins, international SWIFT/SEPA transfers, other Visa/Mastercard cards, and internal transfers within Capitalist

- Team Tools: Task delegation, subaccount management, and card limit settings

- Budget management tools: Financial reports

- Security: 3D Secure Technology

- Notifications & 3DS Codes: Telegram

- Registration: Standard website sign-up, email verification, request submission via personal account, activity questionnaire, and a short interview with a manager

- Support: 24/7 Telegram assistance

- Additional perks: Dedicated account manager

3. Spendge

Spendge offers virtual cards with low costs for advertising payments. The brand's mission is to help users maximize their ad spend while keeping expenses minimal. Virtual cards for Facebook Ads are the company's flagship product, alongside options for Google Ads and TikTok Ads. All cards run on the Visa payment network and are optimised for ad platforms. There are no limits on the number of cards users can generate.

User feedback has been positive, with cards helping to minimise declines and eliminating the need for BIN selection. However, as the service is relatively new to the market, many key features are still in development.

Features:

- BINs: 10 BINs from US and European banks

- Card top-ups: USDT (TRC20, ERC20), BTC, SWIFT/SEPA bank transfers, Visa/Mastercard, Capitalist, transfers from partner service balances

- Team tools: Create team accounts and distribute cards

- Budget management tools: Transaction history available in real-time via the user dashboard

- Security technologies: 3D Secure Technology available on select cards

- Notifications & 3DS codes: Telegram bot, messages

- Registration: Users must provide their details and await registration approval. The entire process is transparent, and account activation can be tracked in real time via the dashboard.

- Customer support: Available via Telegram and the website

- Additional perks: Crypto invoices and expense tracking tools currently in development

4. Traffic Heroes

Traffic Heroes is a platform that provides virtual cards for ad payments across multiple platforms. All cards operate on the Visa network and are generally well received by Meta's anti-fraud systems, making them a reliable choice for Facebook Ads. Service terms are largely tailored to individual user needs.

One of the platform's main advantages is the absence of transaction fees for payments. However, fees apply to other operations, such as declined transactions, with rates set individually. The top-up fees vary depending on the method: bank transfers are free, while Capitalist deposits incur a 1.5% fee, though transaction fees remain at zero.

Features:

- BINs: 30 BINs from US and European banks

- Card top-ups: USDT TRC20, bank transfers (WIRE), and the Capitalist platform

- Team tools: Not available

- Budget management tools: Downloadable expense reports

- Security technologies: 3D Secure available on select BINs

- Notifications & 3DS codes: Messages via the user dashboard

- Registration: Standard website form with email confirmation

- Customer support: 24/7 support via Telegram and website live chat

- Additional perks: Free virtual cards

5. LinkPay

LinkPay provides virtual cards for online payments, including ad expenses. All cards are credit-based and supported by Visa and Mastercard. The platform's Multi Ads card is designed for advertising on major platforms, particularly Facebook, where it performs well in verification checks. Users can generate an unlimited number of Multi Ads cards.

Cards are available via a subscription model, offering cost-effective usage terms. For instance, the Plus plan provides access to 100 free virtual cards with enhanced rates and increased cashback.

One of LinkPay's standout benefits is its competitive fee structure --- there are no fees for balance top-ups, withdrawals, or declined payments. The platform has gained strong traction among users worldwide.

Features:

- BINs: 5 BINs from CIS and European banks

- Card top-ups: 7 major cryptocurrencies, SWIFT/SEPA bank transfers, and card-to-card transfers

- Team tools: Task distribution, role assignment, and card limit settings

- Budget management tools: Financial reports available via the user dashboard

- Security technologies: 3D Secure

- Registration: Website form, KYC not required

- Customer support: 24/7 support via website chat and Telegram

- Additional perks: 3% cashback

Why Facebook blocks payments

Facebook closely monitors transactions and analyses them based on several factors. The main reasons for payment blocks include:

- Geographical mismatch:

If your card is issued in one country but your account is registered in another, this raises red flags. Facebook may block the payment.

- Low card trust:

Cards without a payment history or issued by lesser-known banks may not be accepted by Facebook.

- Sudden budget increase:

A rapid rise in ad spend can trigger Facebook's fraud detection systems.

- Frequent card changes:

Regularly updating payment details can appear suspicious.

- Same card used across multiple accounts:

If a single card is linked to several ad accounts, Facebook may associate them and impose a block.

It's important to note that Facebook does not disclose all its algorithms. Sometimes, blocks occur without an obvious reason. However, following a few simple guidelines can help reduce the risk.

How to minimise the risk of payment blocks

To avoid payment issues, consider these best practices:

1. Choose reliable services.

Not all virtual cards are suitable for Facebook. Use those that are known to work without issues.

2. Match your card's geography to your account.

If your account is registered in Europe, your card should be European too.

3. Avoid frequent card changes.

Using a new card every day can make Facebook suspicious.

4. Monitor your spending.

Do not increase your budget too abruptly. Growth should be gradual.

5. Keep accounts separate.

Do not use the same card for multiple ad accounts.

6. Check your balance.

Insufficient funds on a card can lead to blocks.

7. Stay within limits.

Some virtual cards have payment restrictions. Exceeding these limits may result in failed transactions.

Conclusion

Facebook maintains strict control over advertising payments, which often leads to issues for media buyers. However, these challenges can be managed.

Virtual cards are the most effective way to ensure stable ad payments. They help reduce the risk of blocks, provide better budget management, and streamline operations.

The key is to choose trusted providers, exercise caution with transactions, and maintain a high-trust account. This will keep ad campaigns running smoothly and budgets optimised without unnecessary losses.

In this article, we've reviewed five services offering reliable payment solutions for advertisers:

- PSTNET stands out with attractive terms, including 3% cashback and zero transaction fees.

- Capitalist provides versatile cards with a low rejection rate.

- Spendge focuses on cost optimization and suits large-scale ad campaigns.

- Traffic Heroes offers customised conditions and flexible financial management.

- LinkPay benefits advertisers with a subscription-based model and cashback.

When selecting a service, it's essential to consider not only fees and top-up options but also Meta's (Facebook) ad payment policies. Choosing the right card will help you avoid payment issues and ensure the smooth operation of your ad campaigns.