Money is becoming more and more digital. While there are fearful concerns that they are dangerous and may be used to breach privacy and even control money flows, we're still using them very widely. Do you use your credit card?

Financial applications are web and mobile tools that help us make payments, track expenses, and have online wallets and credit cards. Therefore, a financial app development company is what you need if you want to discover how such apps are created and build one by yourself.

Here, let's focus on various fintech app types and see various examples of them. After that, we'll explore several companies and describe them shortly so you'll understand how to choose them. We'll start with the overview.

Financial apps and their benefits

The benefits of financial apps are grounded in their ability to manage your money and provide you with clear statistics. Thus, you'll manage your money much smarter while applying less effort to this. It'll help you to save more money and spend it more efficiently. In addition, digital money services enable you to transfer money abroad, even in different currencies, with minimum commission and maximum speed.

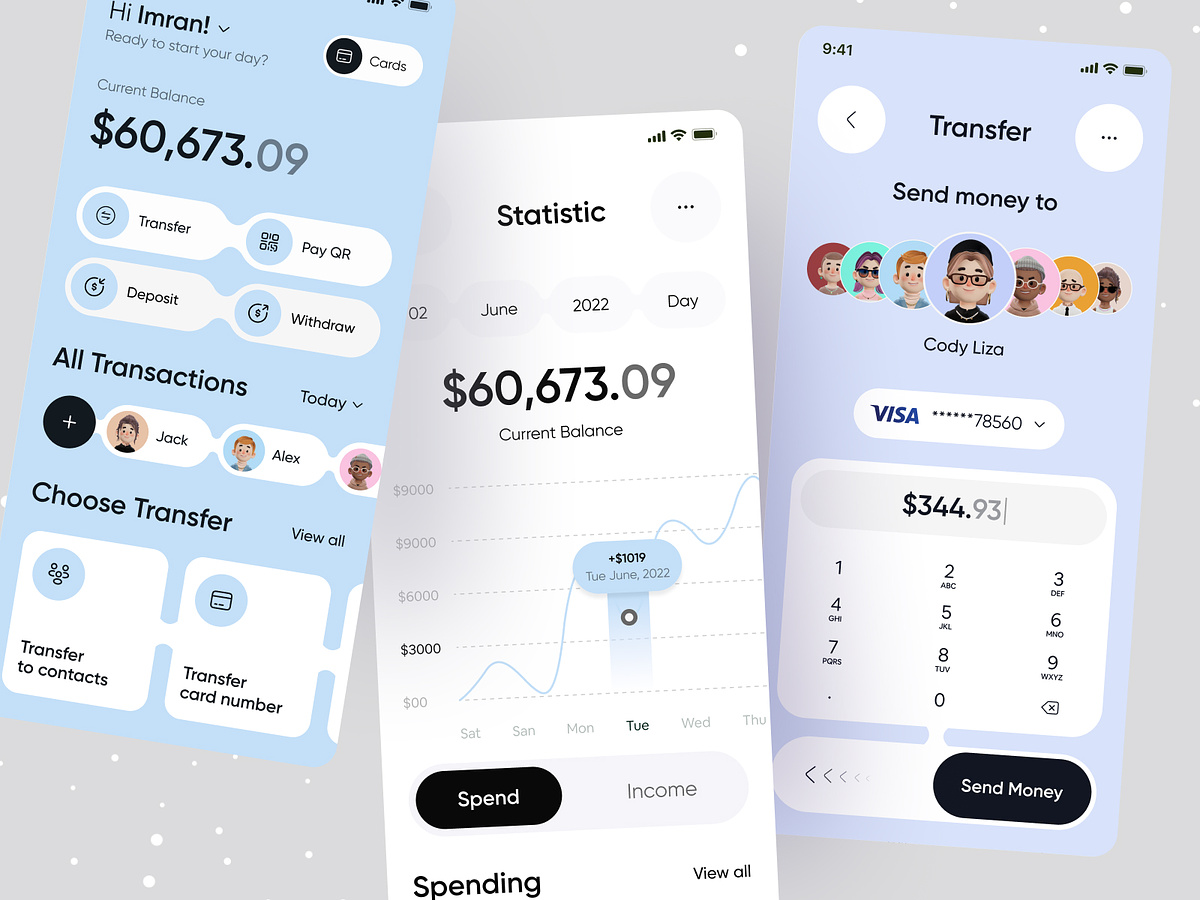

Source: Dribbble

A financial app concept designed for money management and transfer: As you see, such apps must provide comprehensive statistics.

Various financial apps have different purposes: some of them are designed purely for transactions or management, while others help you trade, invest, or find good insurance for your property.

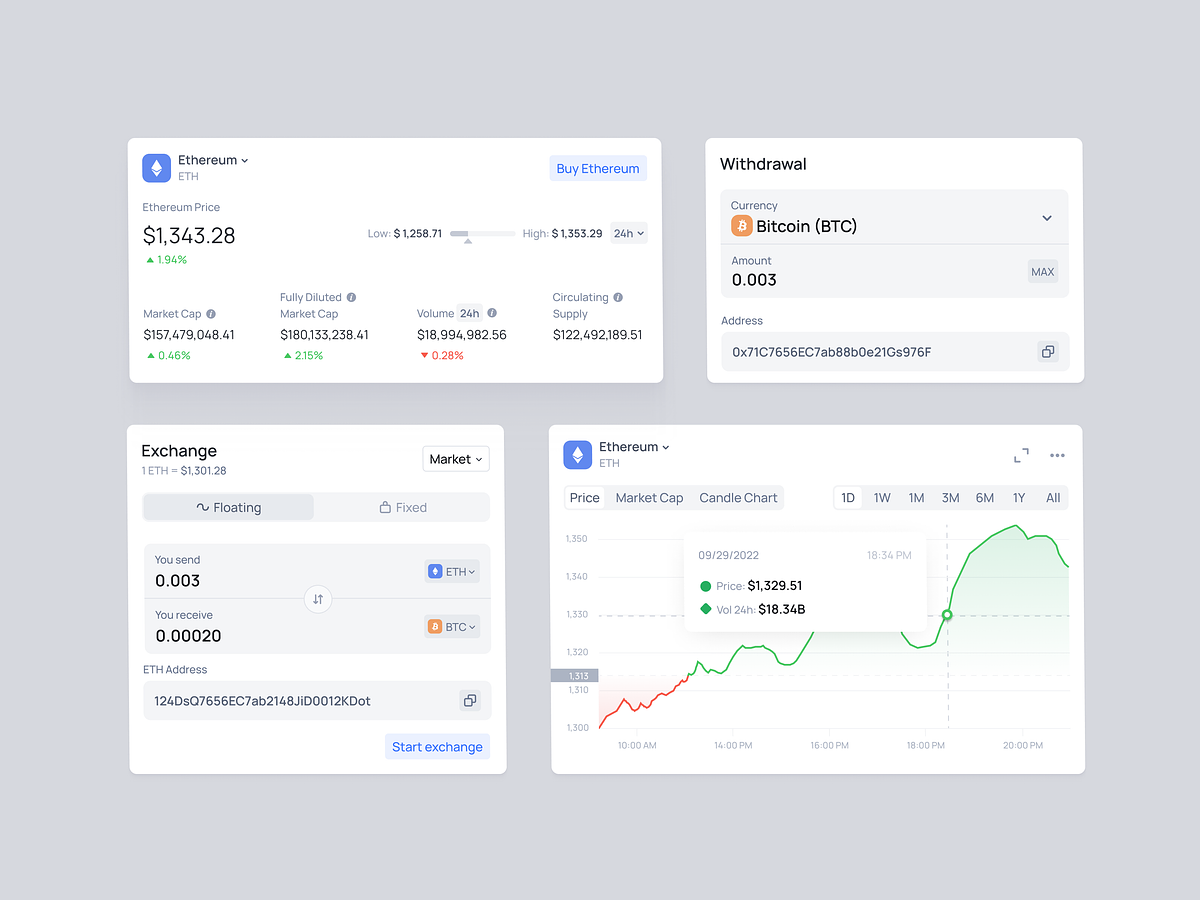

Source: Dribbble

Another financial app concept: this one is designed for trading and currency exchange, especially crypto, so it has a lot of statistical data.

Before examining various financial app types, let's overview their market shortly.

Fintech apps market

Financial apps become more and more popular, as people start to manage their money online more often. It's much easier and more convenient, and security measures are developing constantly, ensuring that people's digital money will be safe.

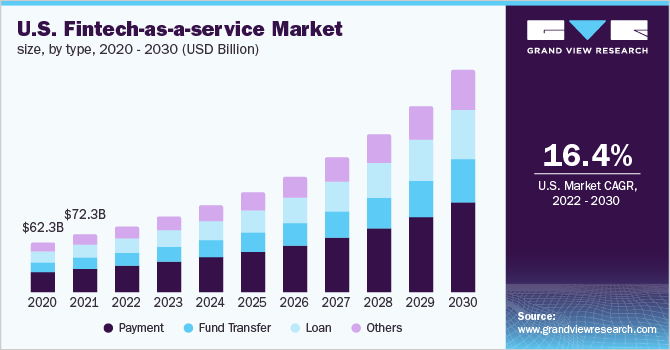

So, no wonder that the market is continuously growing, as you can see below. There are various predictions regarding this field, as it's hard to expect anything from such a dynamic field, but it'll certainly have more than $400 billion by 2030, and has almost $100 billion today.

Predictions on the fintech services market growth. Source: Grand View Research

There is plenty of space on this market, and it waits for you to explore it! Let's overview several popular types of financial apps and then discuss the qualities of good app developers.

Types

Financial applications can occupy any niche focused on the usage of money. While the majority of modern apps have payment options, either for in-app purchases or money transfers, fintech apps are related solely to money management in any form. Let's see several types of them, but remember that they are often interconnected.

- Mobile banking is one of the largest categories: these apps allow users to access their accounts, check balances, transfer funds, pay bills, and perform various banking transactions. They may be provided by traditional banks, or developed by neobank companies, which are fully online.

- Payment apps are another large category. They enable users to store digital money, either by linking their bank accounts or credit cards or providing digital wallet directly. Some of them even issue their own cards, if they have all required permissions for that.

- Investment apps allow users to invest in stocks, mutual funds, crypto, and other financial instruments.

- Finance management apps help users manage their finances by tracking income, expenses, and budgeting.

- Cryptocurrency wallets allow users to buy, sell, store, and manage cryptocurrencies like Bitcoin, Ethereum, and others. Some of them are integrated with crypto exchanges.

- Loan apps offer users personal loans, mortgages, or other types of credit directly from their mobile devices, with application forms and online approval.

- Digital insurance is helpful to purchase and manage insurance policies for health, auto, home, and travel, without visiting insurance offices and often with help of embedded AI services.

What does a good developer need?

Before proceeding to the actual companies, let's figure out several points of what you should search for.

- Proficiency in the fintech industry is the foremost quality you need to watch. See some examples of already developed apps, read their blog articles, ask questions to their support team. It'll provide you with the full picture of their skills.

- Communication is no less important here: if you cannot understand each other and negotiate about the work, you'll only spend time in vain. Communicate with the company's representatives, ask them several questions, and discuss some topics of finance app development. These talks will show you whether you have the match.

- Clear working conditions include all stages where the company will develop your app, all working processes clearly written and scheduled, and post-development support.

- User reviews and company's portfolio are what you need to check the company's actual results. What've they created and what are customers' opinions about it? Answering all these questions will ensure you that the company you're planning to work for is worth it.

Examples of companies

Let's now provide the ten companies: each of them has their unique view on the app development, so we describe them shortly and you'll choose the one you need.

- Purrwebworks in various industries, including fintech, and specializes in cross-platform web/mobile app development, user interface design, and MVPs (minimum viable products) of services.

- Perfsol provides the whole development cycle of various software, including user interface and DevOps. It specializes in fintech, healthcare, and video streaming industries.

- The Software House mostly develops web and cloud services and works in various areas, but specializes in financial apps.

- Django Stars works with Python Django framework for web development, focuses on complex apps building, and fintech is one of its primary specializations.

- Hedgehog labs develops software of various complexity in various industries with the full consulting and post-development support, but it's quite an expensive service.

- Tech Exactly specializes in fintech and healthcare services and develops on various platforms, usually using blockchain to ensure safety of their solutions.

- Brainhub focuses on cross-platform enterprise software development in various areas, including fintech.

- Itmagination focuses on enterprise solutions, too, striving to provide the most innovative solutions possible, using the most recent developments, such as AI and cloud computing.

Conclusion

There are plenty of financial app types: all of them focus on money management, tracking, and exchange.

Companies that develop financial apps are various web and mobile development agencies around the world, with different approaches and missions, despite similar professions. To choose the right one, check their industry proficiencies, case studies, and blog articles, and ask a few questions. Orient also on their approach to work and how it correlates with your own. It'll give you insights into which company to choose.