Background and Introduction

In the digital age, product management in P&C insurance has seen a revolution due to the use of emerging technologies like Artificial Intelligence, Machine Learning, and Predictive Data Analytics. These digital tools help insurance companies improve their products by customizing offerings, making underwriting faster, and boosting customer interaction. Insurers can now better judge risk, fine-tune pricing models, and cut down on fraud, by not only gathering massive data but also being able to make correlations and advance decision making like never before. This leads to significantly improved and effective operations and also provides an edge in the industry.

Digital product management enables P&C insurers to innovate quickly and adapt to market needs at an accelerated pace, offer smooth customer experiences, right from managing claims to renewing policies, and launching multiple channel solutions like mobile products, and self-servicing web portals. They get ahead with competition with new technologies like telematics for car insurance, smart home devices for house insurance, and similar other usage-based insurance products.Some of the basic advantages of digital product management in property and casualty insurance includes:

- Allowing Customer-centric approach: Technological acceleration like tailoring insurance policies and handling claims through the use of AI/ML models, makes it possible to be more transparent and cheaper than the competition. How the existing and prospective customers are connected to the services, ultimately decides whether new customer relationships are formed and if the existing customer are engaged to be loyal over the long term.

- Reduction in Spending for P&C Insurance Companies: The digital transformation programs reduce the operating expenditure through efficiency improvements. This business process simplification allows the insurance company to get away with the old support staff and enable online service delivery models.

- Increased Scalability: Improved digital capabilities allow the quick scaling up of the operations of the insurance companies. Low costs along with a larger customer base results from streamlined processes.

- Reduced Risk / Fraud Prevention: With state-of-the-art technologies, P&C insurance companies can better determine their risks by monitoring the actions of their customers to be in a position for more tailored policies while also encouraged to minimize riskier driving behaviors.

Overview Of Digital Product Management

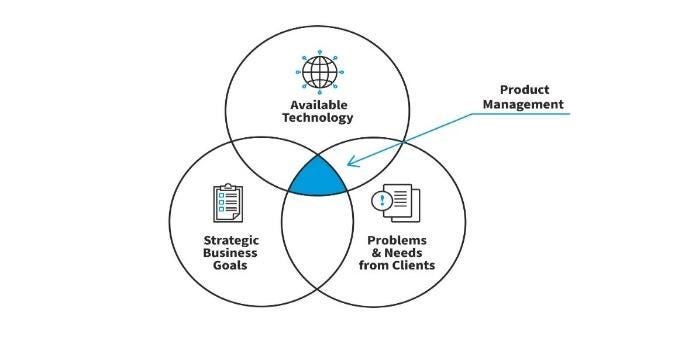

Product management, traditionally, is the process of creating products, services, and experiences that are commercially viable to the organization, valuable to the customer, and at the same time provides speed to market ability. Product Manager (PM) is central actor in the product management process --- saddled with responsibility and accountability for the product's success, but usually doesn't carry the authority over resources required to deliver results. In most modern organizations, the responsibility is formal (via a job description), but it is not uncommon for individuals to take on informal PM roles (as in "somebody's got to do it"). Recognized responsibilities of the product manager include product requirements, release definition, product release lifecycles, team creation for product introduction, and business case preparation & implementation. Below are some of the basic tenets of product management:

Figure 1: Product management

Analytics: Digital products generate data that can be leveraged by the development team and by end users across the entire product life-cycle. Therefore, the ability to collect and analyze data becomes an integral part of DPM.

Business Model: Traditional business models would always start off with a well-defined and finalized business plan without scope of changes and so Product Managers would essentially be tied to it. However, the dynamic nature of digital products requires an approach that is less tedious and more amenable to change. Business model thinking focuses on the high-leverage elements within a business plan and on the inter-connectedness between them. Doing so makes the 'business aspects' of product development more consumable by the overall organization and encourages constructive discussion.

Coordination: Coordinating or integrating people and processes is a core aspect of a PM role. In fact, the phrase "connecting the dots" quite accurately describes what a PM does. PM tasks typically includes, gathering user stories, specifying customer needs, tracking profit and loss, and aligning product decisions with the business model. These are carried out in conjunction with other functions such as marketing, operations, underwriting and claims. The need to manage multiple perspectives is one of the reasons why coordination thinking is a key element of DPM. A second benefit from coordination is improved efficiency.

Design Thinking: The practice or process of design thinking consists of four distinct dimensions. The practice is empathetic and user-centric, with problems and solutions framed in terms of the interaction between the product or service and its user environment.

Impact Of Digital Transformation On Insurance Industry

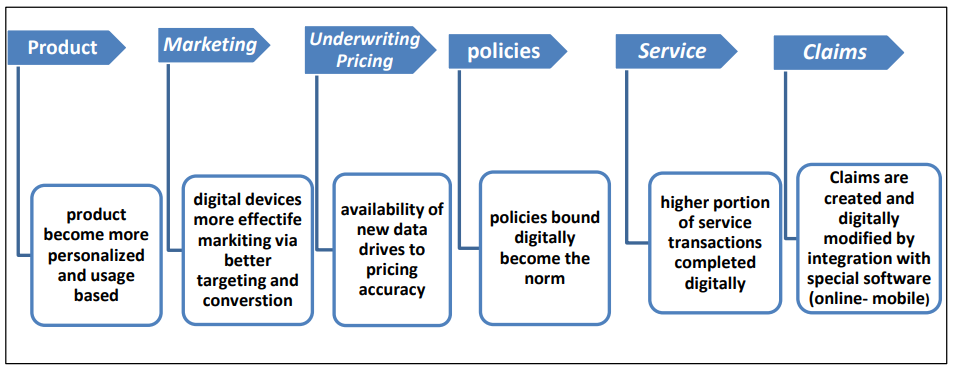

Customers' buying habits are radically altered by digital empowerment. Even the insurance business is aware of this impending transformation and knows it must move quickly to adapt. The insurance companies have been looking at the possibility of self-transformation over the last five years[1]. An opportunity has arisen in the digital era. A fresh product, a fresh advertising approach, updated data used for underwriting pricing in a more precise and expert manner, simplified purchasing and policy growth tracking for customers, a customer-centric, innovative business model, enhanced connectivity across services, cutting-edge technology, real-time data, and a stronger system to identify fraudulent claims through big data analytics are all necessary.

For a visual representation of the far-reaching effects of digital transformation on the insurance sector, see figure 2 below:

Figure 2: Transformation in many levels

- Product: Digitalization affects customer behavior. Buyers like self-service, many channels, and customized items. These personalized contacts and offers enable insurers to focus on clients hence tightening customer focus. Analytical tools that "listen" to consumer inputs and recognize trends can find new product launch prospects.

- Marketing: Insurance businesses are adapting to changing consumer behavior by targeting them through targeted mobile and digital channels, rather than relying on conventional growth levers like TV advertising. Customer and prospect outreach strategies include email, social media, internet, mobile, phone, and direct mail. Many insurers use multiple channels, but channel transitions are poor.

- Underwriting pricing: User- and behavior-based pricing enabled by rich customer data, telematics, and increasing computing power may lower entrance hurdles for user without loss of experience. Rich customer data and greater computing power enable usage- and behavior-based pricing, which may lessen user entrance barriers without losing experience.

- Policies: Policyholders can purchase coverage with the simple touch of a button. Insurance policies can be complex, but self-service dashboards simplify things like calculating premiums and looking at long-term financial planning.

- Services: Rich customer data and greater computing power enable usage- and behavior-based pricing, which may lessen attacker entrance barriers without losing experience.

- Claims: Similar to marketplace aggregators like Walmart, Amazon, Facebook and LinkedIn, Insurance companies need to go keep customer experience at the center of servicing and managing claims, and by enabling access to multiple devices at the same time.

Paper Review

This section provides related work on property & casualty insurance through digital product management.

- The article, "Innovatizing the Insurance Business in the Development of Digital Economy" outlines the most recent developments in the digital economy's innovation of the insurance industry and argues that insurance sectors are becoming increasingly conscious of the significance and role of digital technology implementation by analyzing the amount of worldwide investments and agreements completed in the InsurTech sector. [2] .

- The article, "Improving the Accuracy and Performance of Deep Learning Model by Applying Hybrid Grey Wolf Whale Optimizer to P&C Insurance Data," utilizes the Hybrid Grey Wolf and Whale Optimization (HGWWO) is employed to assess the behavior of P&C insurance clients, in conjunction with a Deep Learning Model. [3].

Conclusion And Future Work

With this more agile and data-driven approach of Digital Product Management, insurers can have more personalized solutioning that would help respond to the expectations of modern consumers. Advanced technologies in particular Artificial Intelligence, Internet of Things among others that are assisting the insurers to optimize their risk assessment and pricing models, reduce costs while enhancing service delivery. However, there are still challenges along the way, with some issues related to data privacy and legacy system integration. Overall, digital management of products will actually benefit the P&C insurance industry in terms of customer satisfaction, scalability, and market competitiveness. As business keep innovating and developments keep on accelerating, the future for the P&C insurance business is definitely about merging technology with customers for sustenance, resilience and growth that are imperative in an increasingly digital world.

References

[1] M. Rodríguez, Velastequí, "The impact of digital transformation on insurance industry," pp. 1--23, 2019.

[2] O. O. Sosnovska, "Innovatizing the Insurance Business in the Development of Digital Economy," Bus. Inf., 2021, doi: 10.32983/2222--4459--2021--7--62--69.

[3] S. Manakhari and Y. Qu, "Improving the Accuracy and Performance of Deep Learning Model by Applying Hybrid Grey Wolf Whale Optimizer to P&C Insurance Data," Eur. J. Electr. Eng. Comput. Sci., 2023, doi: 10.24018/ejece.2023.7.4.548.